Crude oil remains the world's most geopolitically charged commodity. Despite robust supply growth and growing energy transitions, turmoil in oil-producing regions continues to ripple through prices.

In June 2025, for instance, global oil surged into the mid‑$70s per barrel amid escalating Iran–Israel tensions and threats to the Strait of Hormuz. For traders, consumers, governments, and central banks, understanding these dynamics is essential.

This article examines how geopolitics moves the oil markets—from chokepoint threats to strategic alliances—and explores what this means for global economies in the years ahead.

What Is Geopolitics in the Context of Crude Oil?

Geopolitics refers to geography, political decisions, and international relations' influence towards global events. In the context of crude oil, it encompasses factors like:

Regional conflicts and wars

Trade sanctions or embargoes

Political instability in oil-producing nations

OPEC+ production decisions

Strategic alliances and rivalries

Maritime security and supply chain routes

These elements often intersect, creating ripple effects that can affect crude oil prices within hours or days.

Examples of Geopolitics Impacting Crude Oil Prices

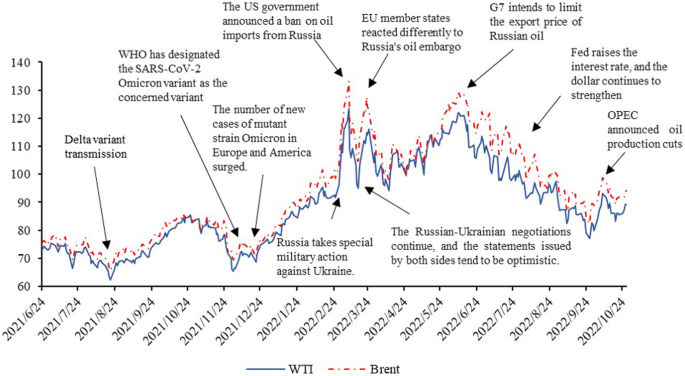

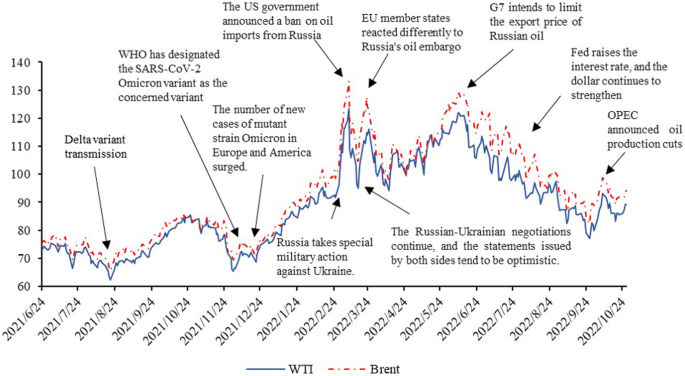

Case Study: The Russia-Ukraine War (2022)

One of the most dramatic recent examples of geopolitics influencing oil markets is the Russia-Ukraine war. When Russia invaded Ukraine in February 2022, crude oil prices spiked above $120 per barrel due to fears of supply disruptions and Western sanctions on Russian exports.

Russia is one of the world's largest oil producers. As European countries sought to reduce dependence on Russian energy, it led to market volatility, shifts in trade routes, and a reconfiguration of global supply dynamics. India and China, for instance, became larger importers of Russian crude, often at discounted prices, while the West scrambled for alternative sources.

In response, the U.S. and its allies released oil from strategic reserves, which temporarily stabilised prices. However, long-term geopolitical changes are continuing to influence crude oil flows and pricing through 2025.

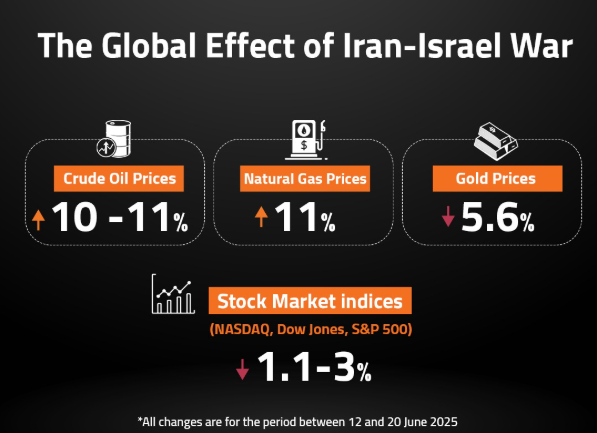

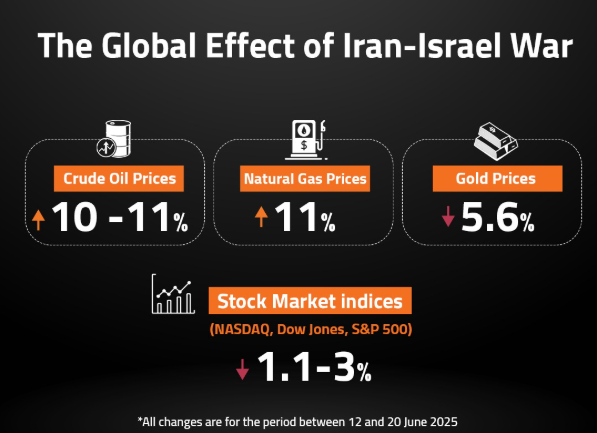

June 2025 Case Study: Oil's Response to Middle East Conflict

In mid‑June 2025, Israeli airstrikes on Iranian nuclear infrastructure led to an immediate 7–11% increase in Brent crude prices. The market reacted swiftly to inflation in geopolitical risk, particularly over fears of supply disruption through the Strait of Hormuz.

Iranian lawmakers even threatened to close the Strait through which nearly 20% of global crude passes. While tanker traffic continued, Brent briefly climbed to $79.50.

Analysts such as Goldman Sachs estimated a $10/barrel risk premium, cautioning that a full disruption could lift prices to $110, while JPMorgan warned of spikes above $120–130 in worst-case scenarios.

However, even as tensions began to ease, oil held near $75–80—reflecting the careful balance between supply fears and reserve capacity elsewhere. OPEC+ production buffers and the flexibility of U.S. shale have provided crucial downward pressure.

Policy Responses & Global Stock Impact

As oil prices surged, equities in import-dependent nations such as Australia dropped by approximately 0.5%. Central banks might respond to rising inflation with tighter monetary policy, which could further strain the markets.

Meanwhile, oil‑exporting economies—such as Nigeria, Angola, Russia, and Gulf states—benefit from price gains in the near term. For sustained stability, though, market resilience relies on diplomatic resolution or strategic reserve use.

Elsewhere, faced with instability, countries like India shifted oil imports away from the Middle East, increasing purchases from Russia and the U.S. in June 2025. Likewise, Chinese Iranian oil imports dropped from ~1.6 million (Q3 2024) to 740,000 bpd in April 2025.

Supply Fundamentals: Inventory, Spare Capacity & OPEC+

June 2025's IEA data indicates a global supply of around 105m bpd, up from 104 mbpd in May, with demand projected at 103.8m bpd. U.S. crude inventories dropped 11.5 million barrels—the largest weekly draw in a year.

OPEC+ held 5.7 of spare capacity, ensuring supply buffers in case of sudden disruptions. Yet without a clear pipeline bypass for Hormuz, actual distribution bottlenecks could still arise.

How Traders React to Geopolitical Events

Market participants don't wait for actual disruptions—they react to expectations and uncertainty. Traders closely monitor:

News headlines and war developments

Policy statements from OPEC+ members

Military deployments or naval presence

Energy diplomacy and international summits

For example, even a rumour of an OPEC+ output cut can lead to speculative buying. Hedge funds and institutional investors often take large positions based on geopolitical risk assessments, which further influence prices.

Traders also use options and futures contracts to hedge or speculate based on geopolitical risk. It can exaggerate short-term price moves beyond what actual supply or demand changes would justify.

Outlook for Crude Oil and Geopolitical Risks in 2025

As of 2025, several geopolitical hotspots continue to influence oil prices:

Ongoing Russia-Ukraine conflict and Western sanctions

Middle East tensions, especially involving Iran, Israel, and saudi arabia

Uncertain U.S.-China relations, especially over Taiwan and trade

Political instability in African oil producers like Libya and Nigeria

Evolving OPEC+ strategies amid global energy transition goals

While technological advancements and alternative energy sources are growing, crude oil remains centre stage. As such, geopolitical volatility will continue shaping oil price trajectories for the foreseeable future.

Forecast Scenarios & Price Ranges

Analysts sketch three plausible scenarios:

Base case: By Q4 2025, the supply buffer is expected to contain oil priced between $60 and $65 per barrel.

Geopolitical Spike: Due to sustained disruptions, particularly in the Strait, a spike could drive oil prices up into the $90 to $130 per barrel range.

Bear Case: Conversely, a bearish outcome resulting from a global economic slowdown and excess inventories could pull prices down to $50 to $60 per barrel.

Conclusion

In conclusion, crude oil prices reflect a complex tug-of-war between supply fears and demand realities. Mid‑2025's Middle East tensions highlight the acute short-term risk premium. But strong fundamentals—such as high inventories, shale output, and OPEC+ flexibility—limit the upside in normal conditions.

For policymakers, businesses, and investors, the key is to monitor chokepoints, reserve use, and global demand shifts rather than react to headlines alone.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.