As of 2025, Poland remains a key player in Europe's economy, offering growth for traders and investors interested in FX markets. However, one common question that arises among global traders is: What currency does Poland use in 2025, and how does it influence trading strategies?

This guide explains Poland's currency, the Polish zloty, and its status, trading dynamics, and relevance to forex and macroeconomic trading.

What Currency Does Poland Use in 2025?

As of 2025, the official currency of Poland is the Polish zloty, abbreviated as PLN. It remains the country's legal tender despite its position in the European Union (EU) since 2004.

The zloty is subdivided into 100 smaller units called groszy and continues to be issued by the National Bank of Poland (NBP), which regulates monetary policy.

The zloty, which means "golden" in Polish, is represented by the symbol PLN. It is commonly traded in pairs such as EUR/PLN, USD/PLN, and GBP/PLN. While Poland is a member of the European Union, it has not adopted the euro and does not plan to do so.

Historical Context: Poland's Currency Evolution

The current zloty (PLN) was introduced in 1995 as part of a major monetary reform following high inflation and economic instability in the early 1990s. It replaced the old zloty at a rate of 10,000:1.

Over the years, the zloty has experienced volatility due to global events, regional politics, and internal economic reforms. However, Poland has maintained steady GDP growth and robust financial management, stabilising the currency.

Poland's strong manufacturing base, relatively low public debt, and integration with EU trade have supported the zloty's role as a resilient emerging-market currency.

Why Poland Has Not Adopted the Euro

Poland committed to adopting the Euro when it joined the EU; however, it has delayed this transition for economic and political reasons. While technically obligated to join the eurozone, the country has not fulfilled all convergence criteria set by the European Central Bank (ECB).

The main reasons for maintaining the Polish zloty include:

1) Economic Sovereignty

Policymakers in Poland value the ability to control their own interest rates and monetary policy. By retaining the zloty, the National Bank of Poland can make independent decisions to stabilise the economy during inflationary periods or financial downturns.

2) Political Sentiment

Public opinion in Poland is mostly sceptical about replacing the zloty with the euro. Surveys conducted over the years indicate that a majority of Polish citizens prefer to retain their national currency as concerns over potential price increases and a perceived loss of financial control.

3) Market Flexibility

The zloty's floating exchange rate system allows Poland greater flexibility in reacting to global financial shifts. It has helped the country maintain competitiveness in exports and attract foreign direct investment (FDI).

Trading the Polish Zloty in Forex Markets

The Polish zloty is considered an emerging market currency with moderate liquidity compared to the U.S. dollar or the Euro. However, it plays a significant role in European and regional currency trading.

In forex markets, PLN is often traded against:

EUR/PLN: The most popular pair, reflecting Poland's deep trade ties with the eurozone.

USD/PLN: Offers insights into the zloty's strength relative to the global reserve currency.

GBP/PLN and CHF/PLN: Less liquid but still relevant for regional investors.

Zloty pairs are actively traded during the European session (08:00–17:00 CET), with peak liquidity around the London open. Spreads can be wider compared to G10 currencies, especially outside of EU trading hours.

PLN Trading Strategies

Carry Trade Opportunities

If Poland maintains higher interest rates than the eurozone, traders may engage in carry trades by borrowing in the Euro and investing in PLN. These strategies can generate positive yields but are sensitive to rate differentials and volatility.

News-Driven Reactions

Traders watch NBP rate decisions and key economic reports to time short-term price movements in PLN pairs. For instance, an inflation jump may lead to expectations of a rate hike, causing the PLN to appreciate.

Correlation-Based Approaches

EUR/PLN often correlates with other CEE currencies, such as the Hungarian forint (HUF) and Czech koruna (CZK). Traders sometimes use relative strength across the region to determine the most favourable trade setup.

Poland Currency Outlook 2025 So Far

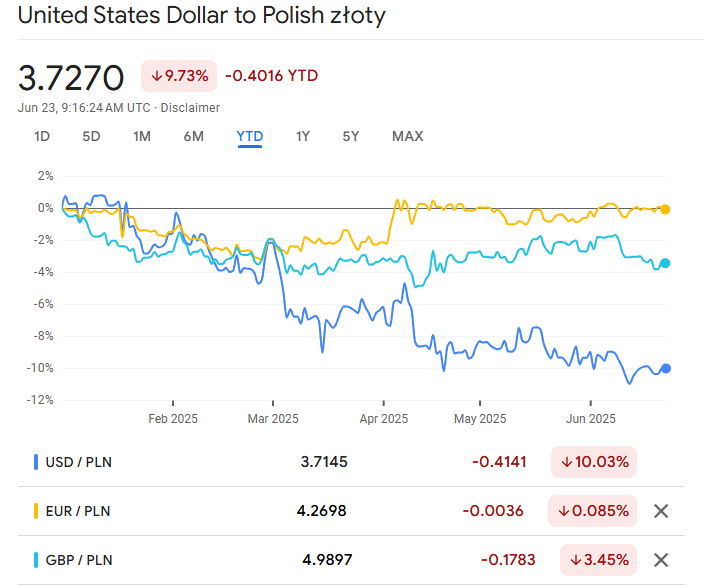

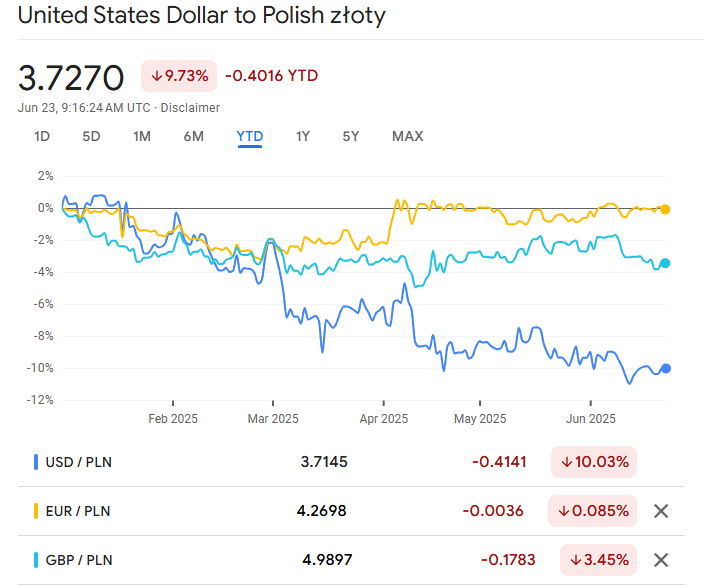

As of June 23, 2025, the USD/PLN exchange rate stands around 3.714, marking a modest 0.31% monthly gain in the zloty's strength. Weekly, PLN fluctuated between 3.680 and 3.733, demonstrating relative stability.

Forecast for the Remainder of 2025

Analysts anticipate the zloty will gradually strengthen through the year. Annual forecasts for USD/PLN indicate a tightening range between 3.46 and 3.77, with an average near 3.63, implying a modest appreciation. Specific monthly estimates show:

June: 3.67–3.74 (avg 3.71)

December: 3.46–3.54 (avg ~3.50)

Other reliable sources project USD/PLN to end 2025 around 3.7520, reflecting its weakness but hinting at mid-year stabilisation.

Underlying Drivers

1) Monetary Policy

Poland's central bank has held the key rate at 5.75%, citing persistent inflation and robust wage growth. Forecasts suggest inflation from ~5% in 2025 to 2.5% by 2027, but no rate cuts are expected until inflation trends decline.

2) Economic Growth & Fiscal Policy

Poland's economy is on track for solid expansion—projected at 3.1% in 2025, up from 2.9% in 2024. However, recent gains by nationalist political forces introduce fiscal uncertainty. A rising budget deficit (above 6% of GDP) risks undermining the zloty's strength.

3) Investor Sentiment

The zloty recently benefited from central European equity inflows, rising about 11% YTD before the June political developments. However, a tighter fiscal outlook may reduce investor appetite for PLN assets.

Conclusion

In conclusion, the Polish zloty (PLN) remains the official currency of Poland. Despite being a member of the European Union for over 20 years, Poland has maintained its currency to preserve monetary independence and economic flexibility.

For forex traders, PLN offers unique opportunities tied to regional economics, central bank policy, and geopolitical developments. It is a valuable currency for diversification, particularly for those focused on emerging European markets.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.