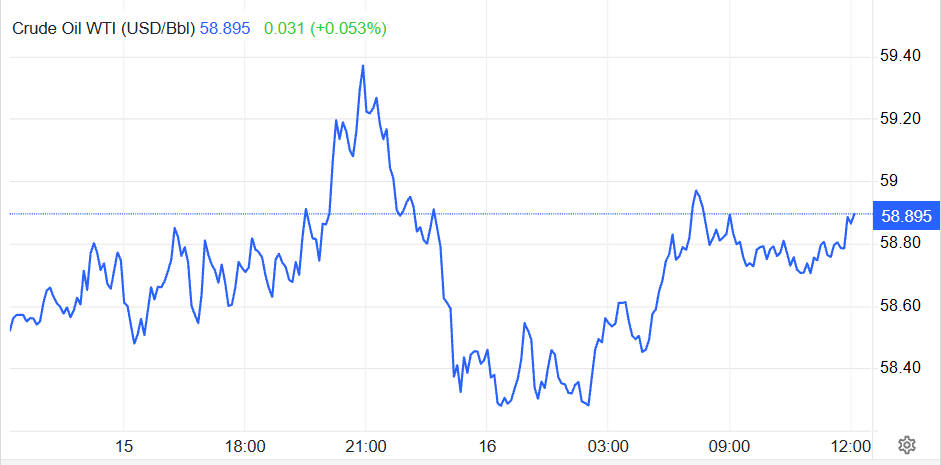

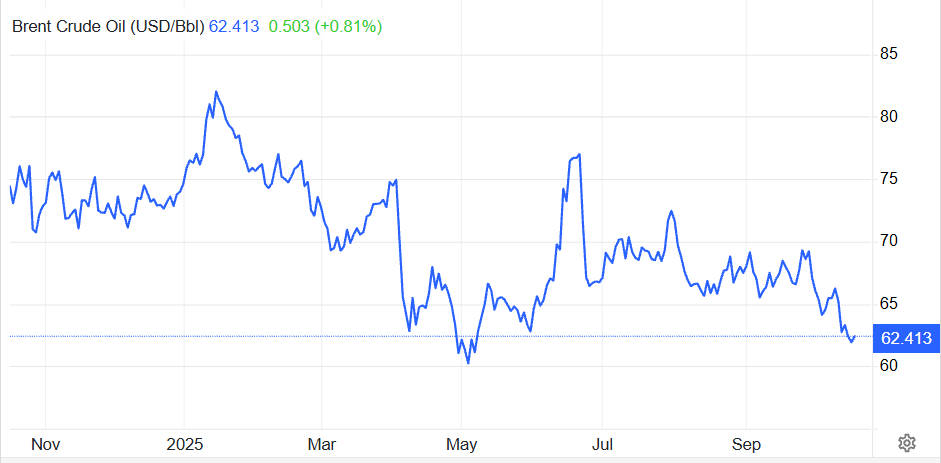

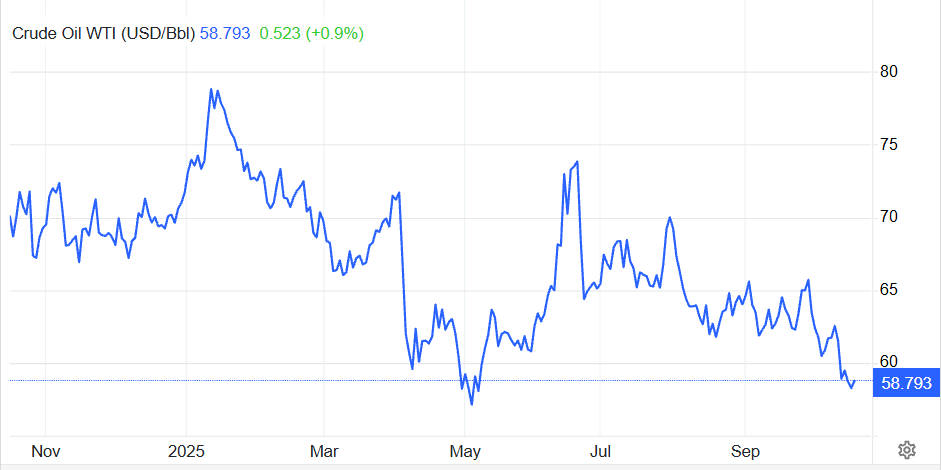

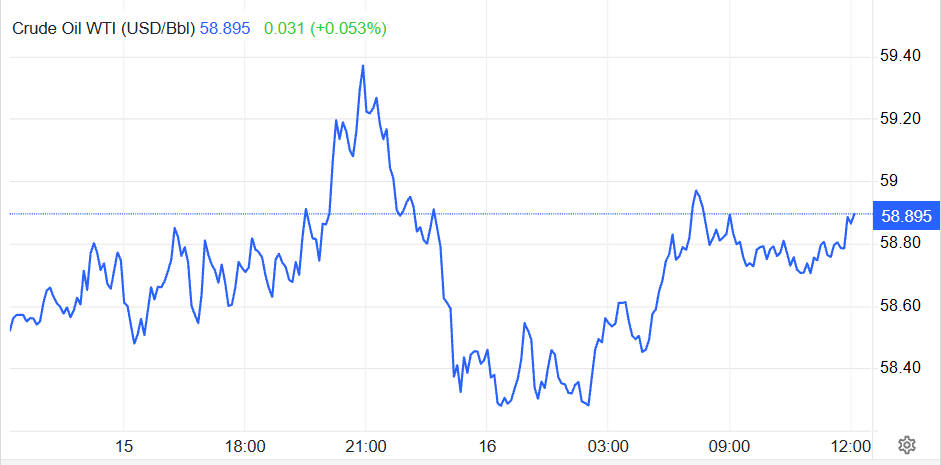

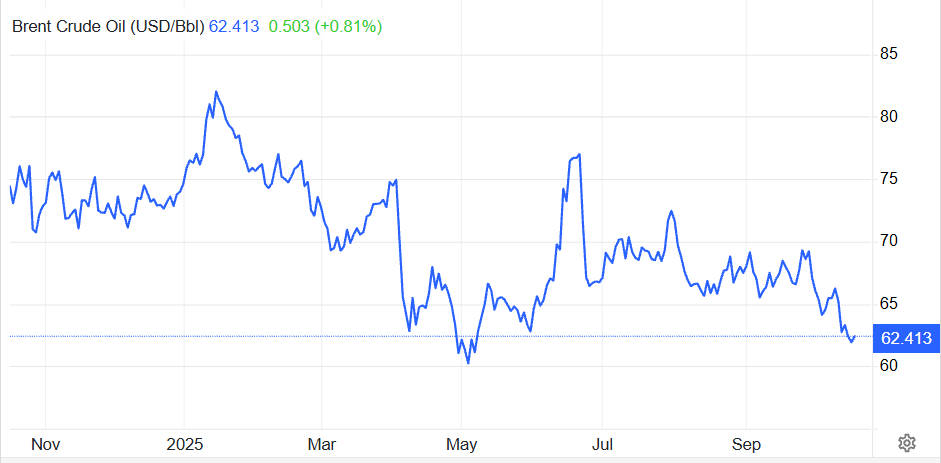

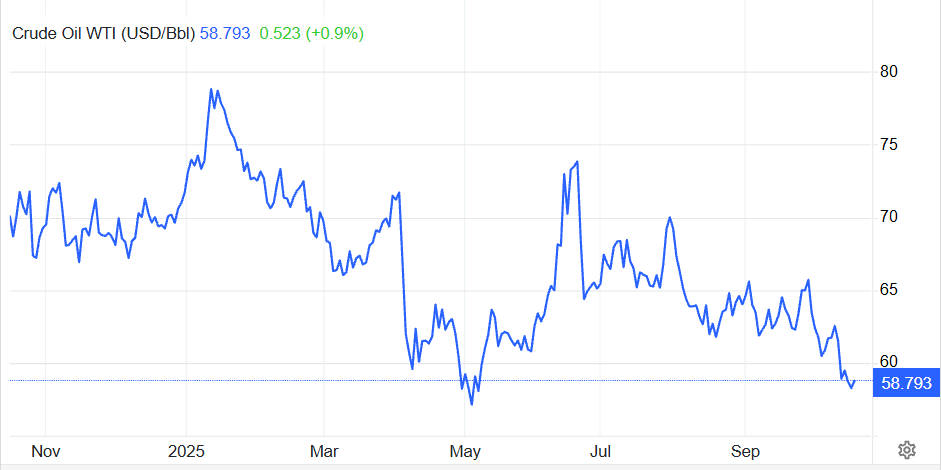

Oil markets have been volatile: just a day prior, Brent dipped to about $62.18 amid concern over excess supply and slowing demand.

These oscillations reflect the intense tug-of-war now gripping crude: on one side, bullish surprises and geopolitical headlines; on the other, structural oversupply risks, weak macro momentum, and rising inventory pressures.

From here, prices may pivot sharply depending on upcoming inventory data, OPEC+ policy signals and Chinese consumption trends.

What happened this week

At the same time, analysts and banks warned of a possible supply surplus next year after OPEC+ increased output and global demand growth weakened; Bank of America even flagged a scenario in which Brent could fall below $50 a barrel. That tension — positive headlines versus structural surplus risks — is driving volatile price action.

What's driving the price: supply, demand and politics

1. Supply-side drivers

Russian flows and logistics — Russia remains a major seaborne supplier; any disruptions, port pressures or rerouting of cargoes can tighten regional balances, but at present Russian exports remain sizable. (Geopolitical headlines can therefore provoke short-term price moves.)

2. Demand-side pressures

3. Geopolitical and policy shocks

Short-term political announcements — for example claims that India will reduce Russian oil purchases — can have an immediate market impact because they change the distribution of buyers and sellers, even if the policy shift is gradual in practice. Traders price in both the likelihood and the timing of such pledges.

Inventories, the immediate price trigger

Weekly US inventory data are the most immediate market trigger: a surprise build in crude stocks typically weighs on prices, while a draw supports them.

A recent Reuters poll expected US crude stocks to have risen modestly (around 0.2 million barrels for the week to 10 October), reinforcing the view of weak near-term demand.

Why inventories matter (short list):

They measure actual supply/demand balance (consumption + net imports vs. production).

Unexpected builds or draws change traders' short positions quickly.

Large, persistent builds can confirm a structural surplus and prompt long-term bearish revisions.

Scenarios and ranges for Crude Oil Price (Brent)

| Scenario |

Key drivers |

Price range (illustrative) |

| Base case |

OPEC+ steady, modest Chinese demand, inventories near seasonal norms |

$55–$70 / bbl (Brent) |

| Bear case |

Accelerating global slowdown, OPEC+ keeps output high, large inventory builds |

<$50 / bbl (Brent) |

| Bull case |

Supply shock (geopolitical disruption), strong restocking or demand surprise |

>$75 / bbl (Brent) |

Bank of America emphasises the downside risk: in stressed scenarios combining US–China trade escalation and increased OPEC+ supply, Brent could test sub-$50 levels. That is a non-negligible risk for investors to model.

Who wins and who loses: sector and policy implications

1. Winners (if prices fall)

Large oil-consuming countries and refiners benefit from lower feedstock costs, reducing inflationary pressure on transport fuel.

Energy-importing emerging markets may see eased current-account pressures.

2. Losers (if prices fall)

Oil exporters dependent on revenue face fiscal stress, potentially prompting production cuts or policy adjustments.

Energy companies with high extraction costs (some offshore or frontier projects) could postpone investment.

3. Financial markets & investors

Practical guidance for market participants

Watch the week's inventory prints (API first, then EIA): these are the immediate price catalysts.

Monitor OPEC+ communications and meeting calendars — even hints about future output can shift sentiment.

Stress-test portfolios for the bear case: model scenarios with Brent at $50 and below, and consider option structures or staggered hedges to manage downside risk.

Short historical perspective

The oil market has a long memory: past price collapses were typically driven by either a global demand shock (e.g. 2008 financial crisis, 2020 pandemic) or a sharp supply surge. Today's combination of rising OPEC+ supply and demand jitters recalls past episodes where a temporary surplus forced prices lower until a supply adjustment or demand rebound arrived.

Conclusion — the near-term verdict

Crude is balancing short-term, news-driven upside against a possibly more significant and persistent downside risk. Political headlines — such as India's stated shift away from Russian oil — can lift prices in the short run, but structural forces (OPEC+ output decisions, resilient non-OPEC production and weak demand caused by trade friction) create a plausible path toward much lower levels unless inventory trends reverse. For traders, the coming weeks of data (inventories, Chinese economic indicators) and OPEC+ signals will be decisive.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources:

[1]https://www.reuters.com/business/energy/brent-crude-futures-up-1-after-trump-says-india-promised-stop-buying-russian-oil-2025-10-16/

[2]https://www.reuters.com/business/energy/bofa-says-us-china-trade-tensions-opec-output-boost-could-push-brent-below-50-2025-10-15/