The Trump administration will revise a Biden-era rule that required the oil

and gas industry to provide nearly $7 billion in new financial assurances to

cover the cost of decommissioning old infrastructure.

The Interior Department said it would develop a new regulation, but did not

give specifics. The move is the latest of measures to boost domestic energy

production amid still-hot inflation.

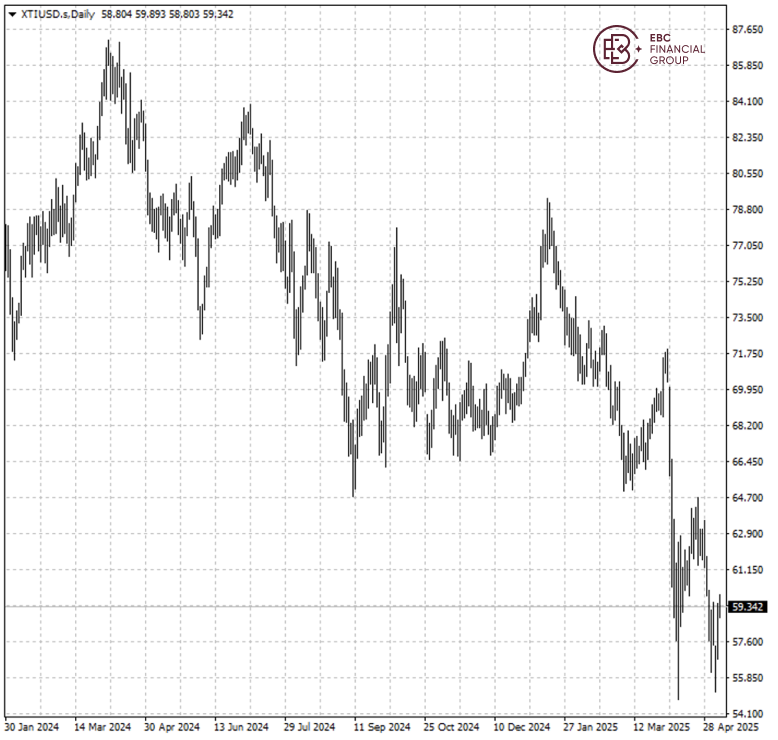

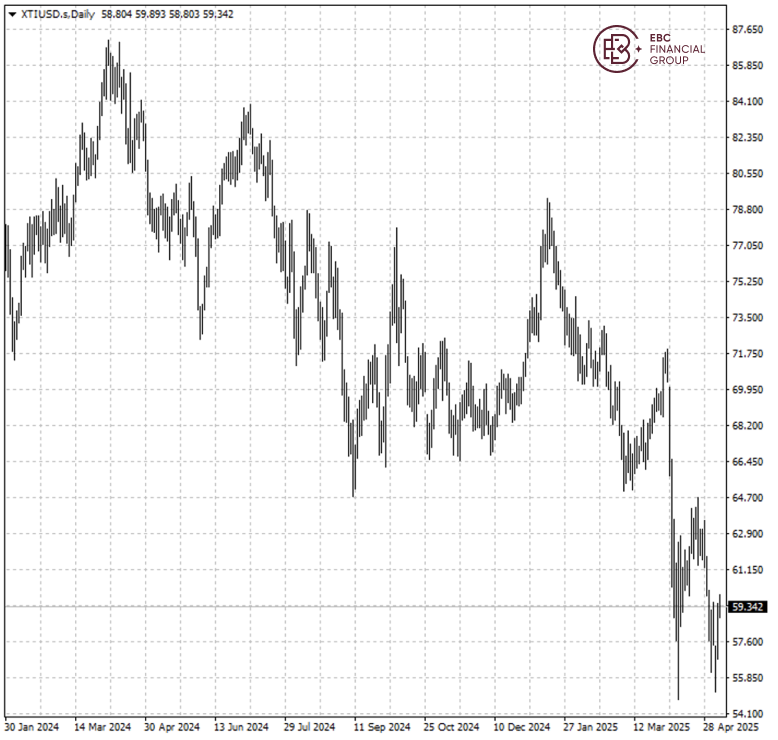

Still some shale producers have recently said they would cut capital

expenditure in response to sliding oil prices, prompting industry warnings that

US production had peaked and could begin falling.

Diamondback Energy said it estimated the number of US fracking crews had

already fallen by 15% this year and would continue to decline unless there was a

rapid turnaround in prices.

At less than $60 a barrel, many US shale producers will struggle to turn a

profit, especially in some of the country's ageing basins. That means OPEC+ and

other major producers will likely steal their market share.

OPEC+ could bring back to the market as much as 2.2 million bpd by November,

five OPEC+ sources said as the group's leader saudi arabia seeks to punish some

fellow members for poor compliance.

WTI crude shot up on Tuesday amid signs of more Europe and China demand, but

it remains below $60. Ongoing nuclear talks between Iran and the West also cloud

oil market outlook.

A tough year

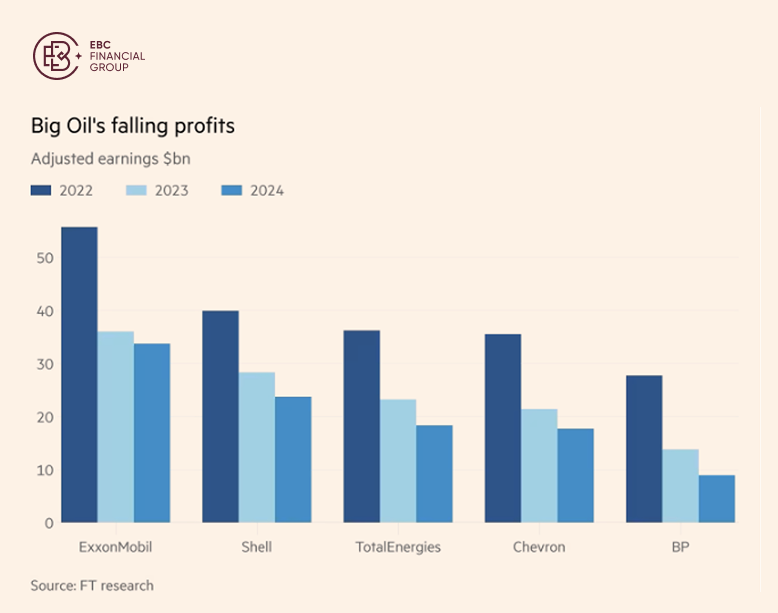

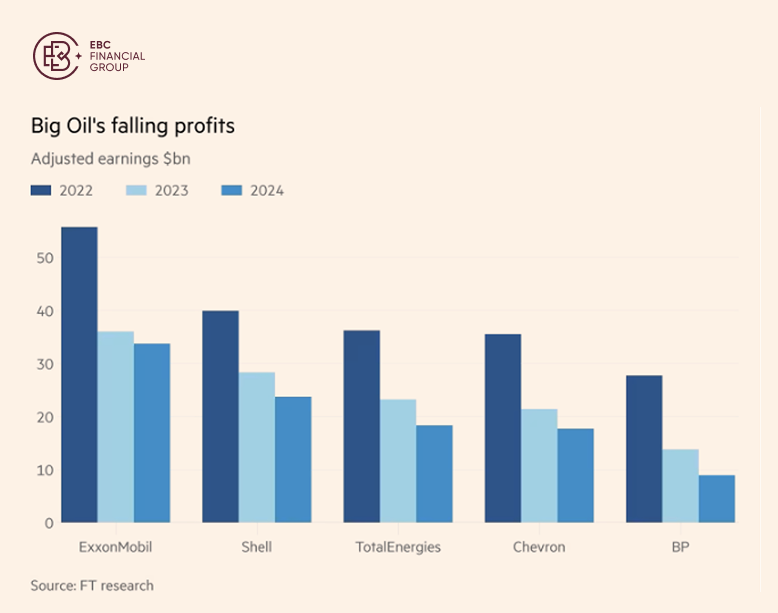

This year is set to mark Big Oil's third consecutive 12-month period of

falling profits. The adjusted net income of five of the biggest western oil

companies fell by about $90bn from 2022 to 2024.

"We now expect global upstream development spend to fall year on year for the

first time since 2020," Fraser McKay, at energy consultancy Wood Mackenzie, said

in a recent report.

The whole industry is feeling the chill. Last month the three biggest western

oil services companies, Baker Hughes, Halliburton and SLB, all raised concerns

about the weakening outlook.

Exxon Mobil announced Q1 earnings that decreased from the same period last

year but beat estimates. Benefiting from prolific production from its Guyana

oilfield, it increased production by 20% year-over-year.

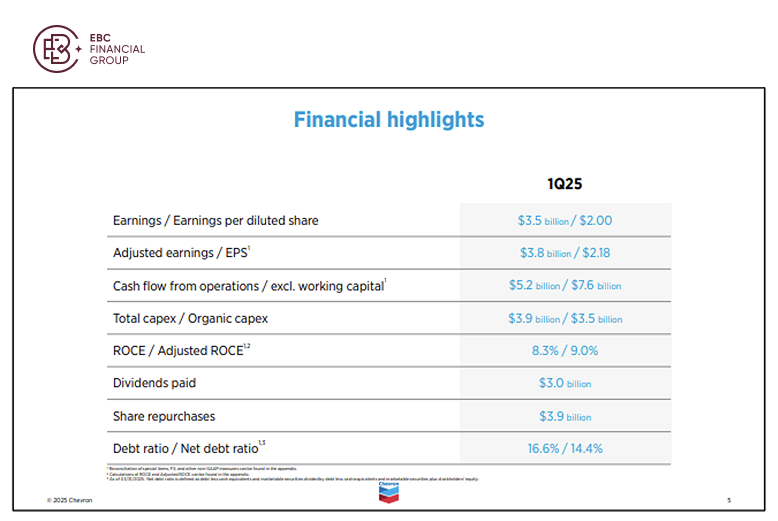

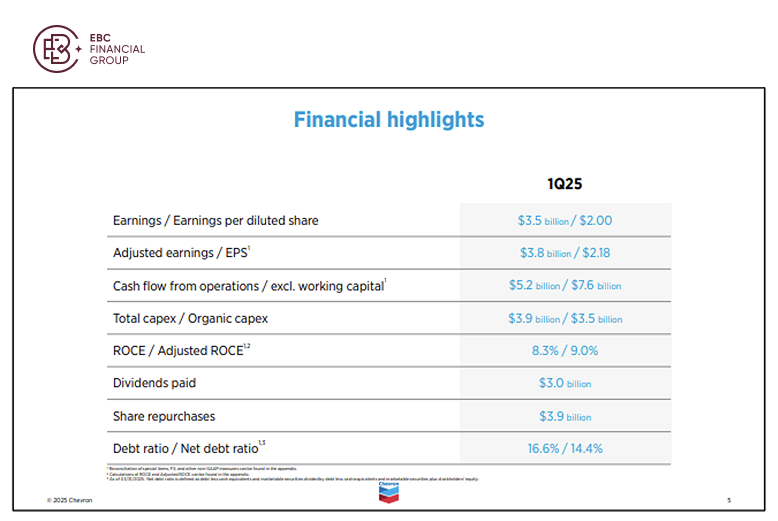

Chevron's financial results met expectations. Refining profit improved from

the previous quarter, though earnings from energy production were down and

downstream operations reported the first loss in four years.

Chevron's Q1 oil and gas production was flat compared to the previous year as

growth in Kazakhstan and the Permian was offset by loss of production from asset

sales.

The company is also set to defend its planned $53-billion acquisition of oil

producer Hess, which would give it a crucial foothold in a prolific oilfield off

the coast of Guyana.

Peer comparison

Big Oil have shown a clear split in how those companies are positioned to

weather the downturn sparked by a slump in oil prices to a four-year low in

April. The difference speaks to where each is in its business cycle.

Investors were focused on share repurchase cuts since lower oil prices would

reduce free cash flow. Exxon repurchased $4.8 billion of shares during Q1, on

track to meet its annual target of $20 billion.

Chevron said it would reduce buybacks to between $2 billion and $3.5 billion

in the current quarter. If rolled forward, that would mean Chevron could land

between $11.5 billion and $13 billion in repurchases for 2025.

With net-debt-to-capital ratio at 7%, Exxon was the only integrated oil

company that did not increase net debt during Q1, said Kim Fustier, head of

European oil and gas research at HSBC.

CEO Mike Wirth issued a stark warning about the firm's possible departure

from Venezuela as a Biden-era license allowing the company to operate in the

country is set to expire.

Earlier this year, the company announced it would lay off up to 20% of its

staff as part of an effort to simplify the business and cut up to $3 billion in

costs. All told, its shares could continue to underperform Exxon's.

Shale firms are more focused on capital discipline these years. Both

companies saw their market cap soar to record peaks in 2022 due to global demand

recovery following victory over Covid-19.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.