Investing is one of the most powerful tools available for building wealth, achieving financial independence, and securing your future. With the right strategies, mindset, and knowledge, anyone can start making money through investing—regardless of experience or income level.

But how exactly do you make money by investing? What methods work best in 2025, and what strategies should you avoid?

This comprehensive guide outlines all the essentials you must understand about generating income through investing. We will examine how investors create earnings, instances, different tactics, and essential guidelines to adhere to.

How to Make Money Investing?

Making money from investing means earning a return on the capital you put into financial assets. There are two primary ways this happens:

Capital Appreciation: The value of your investment increases over time, and you sell it at a higher price.

Income Generation: You receive regular payments from your investments, such as dividends and interest.

Some investments offer both forms of returns, such as dividend-paying stocks that also rise in value. The path you choose depends on your goals, risk tolerance, and time horizon.

Why Investing Is Essential in 2025

In 2025, inflation continues to erode the purchasing power of cash. Saving alone is no longer enough to grow wealth. Investing allows your money to work for you, outpace inflation, and build value over time.

With global markets more accessible than ever through online platforms, even small investors can participate in stocks, bonds, and etfs. As technology advances and more companies go public, investing becomes a necessary part of wealth creation and retirement planning.

Popular Ways to Make Money Through Investing

| Feature |

Stocks |

Bonds |

Mutual Funds |

ETFs (Exchange-Traded Funds) |

| Definition |

Shares of ownership in a company |

Loans to governments or corporations |

Pooled investments managed by professionals |

Pooled funds tracking indices/sectors |

| Ownership |

Yes (partial ownership of a company) |

No (creditor, not owner) |

Indirect ownership of diversified assets |

Indirect ownership of diversified assets |

| Risk Level |

High (depends on company performance) |

Lower than stocks (credit risk varies) |

Moderate (depends on fund type and manager) |

Moderate to low (depends on index tracked) |

| Return Potential |

High (capital appreciation, dividends) |

Low to moderate (fixed interest) |

Varies (dividends, capital gains) |

Varies (typically reflects market/index) |

| Liquidity |

High (traded daily on exchanges) |

Medium (some bonds are less liquid) |

Medium (bought/sold at NAV, not intraday) |

High (traded like stocks on exchanges) |

| Costs/Fees |

Low (commission-free options exist) |

Low to moderate |

Moderate to high (management fees, loads) |

Low (expense ratios usually

|

| Diversification |

Low (single company exposure) |

Low (unless part of bond fund) |

High (invests in many assets) |

High (index-based, sector-based) |

| Management |

Self-directed or broker-assisted |

Self-directed or bond manager |

Professionally managed |

Passive (most) or active (some) |

| Tax Efficiency |

Moderate (capital gains taxed) |

Interest taxed as income |

Less tax-efficient (capital gains distributions) |

More tax-efficient (in-kind creation/redemption) |

| Income Generation |

Through dividends (if applicable) |

Through fixed interest payments |

Dividends and capital gains distributions |

Dividends and market-based appreciation |

| Investment Horizon |

Short to long term |

Medium to long term |

Medium to long term |

Short to long term |

| Best For |

Growth-focused investors |

Income-seeking conservative investors |

Hands-off investors looking for diversification |

Beginners and cost-conscious diversified investors |

Stocks

Investing in company shares is one of the most popular and accessible ways to build wealth. You can earn money by:

Long-term stock investing, especially in blue-chip or growth companies, has historically offered strong returns.

Bonds

Bonds are debt instruments issued by governments or corporations. Investors earn by receiving fixed interest payments (coupons) over time. While returns are generally lower than stocks, bonds provide steady income and help diversify portfolios.

Mutual Funds and ETFs

They offer a low-cost way to gain exposure to different sectors and geographies. ETFs (Exchange-Traded Funds) are traded like stocks and often mimic indices, while mutual funds are actively managed.

Both can appreciate and provide income through dividends.

How to Start Investing: Step-by-Step Guide

Step 1: Define Your Financial Goals

Start by identifying what you're investing for. Are you saving for retirement, building wealth, or buying a home? Your goal determines your time horizon and risk tolerance.

For example, a long-term retirement investor can handle more risk than someone saving for a down payment in two years.

Step 2: Build an Emergency Fund

Before investing, ensure you have a safety net of 3–6 months of expenses saved in a high-yield savings account. It protects you from having to sell investments during market downturns.

Step 3: Choose Your Investment Platform

Pick a regulated online brokerage or app that fits your needs. Look for low fees, a user-friendly interface, educational tools, and access to markets. Examples include:

Step 4: Pick Your Assets

Diversify across asset classes. Beginners often start with index funds or ETFs, which offer broad exposure without the need to pick individual stocks. As you gain confidence, you can explore specific assets such as tech stocks and dividend payers.

Step 5: Monitor and Rebalance

Regularly track your portfolio and make adjustments based on performance and changing goals. Rebalancing ensures you maintain your desired asset allocation.

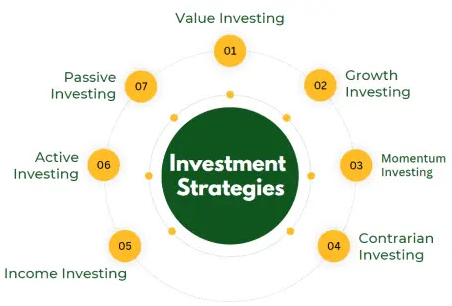

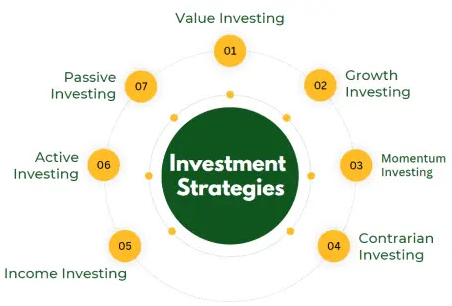

Investment Strategies to Make Money Over Time

1) Buy and Hold

This long-term strategy involves purchasing investments and holding them through market fluctuations. It relies on the principle that markets tend to rise over time. Warren Buffett is a famous proponent of this method.

2) Dollar-cost averaging (DCA)

Instead of investing a lump sum all at once, you invest a fixed amount regularly—weekly or monthly. It reduces the impact of market volatility and helps you buy more shares when prices are low.

3) Value Investing

This strategy focuses on finding undervalued assets relative to their intrinsic worth. Value investors seek stocks that are trading below their book value or historical price multiples.

4) Growth Investing

Growth investors target companies with high earnings potential, even if their current valuation is high. These are typically tech or innovative firms expected to expand rapidly.

5) Dividend Investing

Investors build portfolios of dividend-paying stocks to generate passive income. Reinvesting dividends (DRIP strategy) accelerates compound growth.

Real-Life Examples

Example 1: Long-Term Stock Holding

An investor who purchased Amazon (AMZN) stock in 2010 at around $120 and held it until 2025 saw returns exceeding 1,000%. Despite short-term volatility, patience paid off significantly.

Example 2: ETF Index Fund Growth

Investing $10,000 in the S&P 500 ETF (SPY) in 2015 would have grown to over $25,000 by 2025, assuming reinvested dividends and consistent growth.

Mistakes to Avoid

To succeed as an investor, avoid common pitfalls:

Trying to time the market

Putting all your money in one asset

Following social media trends without research

Ignoring fees and taxes

Overreacting to news and volatility

Success in investing is more about consistency, discipline, and patience than picking "the next big thing."

Conclusion

In conclusion, making money through investing is a realistic goal for anyone who follows the right approach. In 2025, technology, market access, and information are more available than ever—meaning you don't need to be wealthy or an expert to get started.

Just remember: Investing isn't a get-rich-quick scheme—it's a journey. But with smart decisions and a long-term mindset, the financial rewards can be life-changing.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.