Crude oil is among the world's most actively traded commodities, with around-the-clock activity from Sunday evening to Friday evening. However, not all hours are equal.

Understanding when liquidity surges, volatility spikes, and market-moving news can significantly impact your entries and exits is crucial. In this guide, we explore optimal trading windows, global session overlaps, and strategic timing to maximise profit when trading crude oil.

Understanding the Crude Oil Market Time

The crude oil market comprises two main benchmarks—West Texas Intermediate (WTI) and Brent Crude—and offers nearly 24/5 trading access via futures contracts, as well as CFD instruments.

Futures operate almost 24 hours from Sunday at 6:00 p.m. ET until Friday at 5:15 p.m. ET, with a break every afternoon.

Brent CFD contracts on platforms like EBC mirror these hours, offering uninterrupted access during global session overlaps.

Trading at peak hours can reduce slippage, tighten spreads, and enhance execution outcomes—key goals for both intraday and swing traders.

The Most Active Sessions

U.S. Session

The U.S. session—from 9:00 a.m. to 2:30 p.m. ET—is where WTI trading is most active. Volume surges during its opening, and each Wednesday's EIA inventory report (10:30 a.m. ET) introduces volatility.

European Session (London)

London dominates from 4:00 a.m. to 11:00 a.m. ET, especially for Brent crude. Liquidity peaks before the U.S. open, offering key move setups.

London–New York Overlap

Between 8:00 a.m. and 12:00 p.m. ET, both major markets operate simultaneously. This overlap consistently delivers maximum liquidity, tighter spreads, and bigger intraday swings.

Strategies for Each Time Window

Trading the London Open

Pre-market analysis should assess weekend events in the Middle East, OPEC rumours, or shifts in Chinese economic figures. Entering at 4 a.m. The ET London open can yield early breakout opportunities.

Trading the New York Open

As the U.S. market awakens, intraday volatility surges. Many traders use opening range breakout strategies to capture moves.

Trading the EIA Release

Volatility during the 10:30 a.m. ET EIA inventory release creates high‑reward opportunities. Limit-style entries, tight stops, and strict trade sizing are essential in this fast-moving period.

Trading the London–New York Overlap

Trend-followers and breakout traders thrive in this period due to sustained liquidity. Traders utilise technical indicators such as VWAP, breakout points, or structural order blocks for entry points.

Trading Overnight and Low-Liquidity

Some traders exploit overnight price gaps using reverse strategies at the next session open. While overnight triggers can be pronounced, low liquidity increases risk.

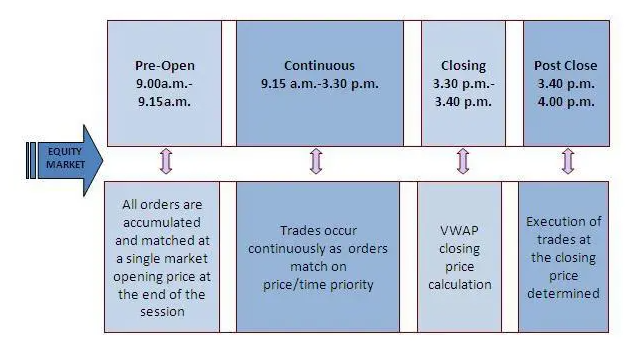

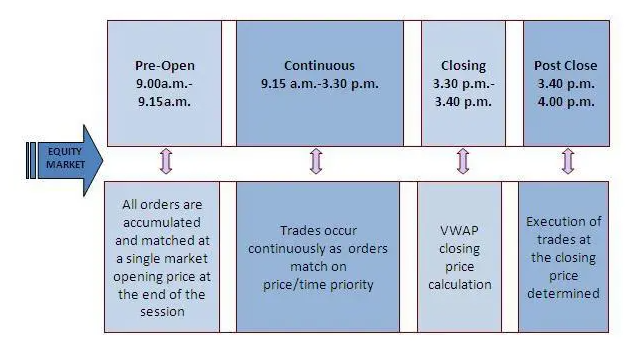

Weekly Trading Flow: Timing Your Strategy

Understanding weekly patterns can help optimise trade timing.

Sunday evening opening sets the tone for the week, often with large range moves as algorithms react to global news.

Sunday through Tuesday, Asian and London overlap tends to stabilise pricing before U.S. session breakout runs.

Wednesday EIA releases typically generate sharp intraday reversals within the 9–2:30 a.m. window.

Thursday and Friday tend to exhibit diminished volatility unless OPEC or geopolitical headlines emerge.

Daily close (around 4 p.m. CT/5 p.m. ET) often prompts volatility spikes as traders adjust futures positions and roll contracts.

Technical Considerations by Time Window

Traders should adapt tools based on session characteristics:

Intraday ACD strategies reference early range breakout points for session direction.

VWAP and real-time candlestick patterns are most effective during overlap periods for intraday entries.

FVGs and order blocks are effective for swing entries during deeper retracements in European sessions.

Stripping trading near daily highs and lows benefits during overnight gaps, but position sizing must account for low liquidity.

During the peak volatility window of 8 a.m. to 12 p.m. ET, use scaled positions and staggered entries to manage sudden moves. Avoid holding large positions overnight, especially around geopolitical or OPEC events.

Be aware of roll dates in futures, which can cause price spikes independent of fundamentals, affecting spot and CFD strategies.

Summary of Best Crude Oil Market Time Trading

| Session |

Time (ET) |

Why It Matters |

| London Open |

4 a.m. – 6 a.m. |

Sets weekly tone; early volatility start |

| London–New York Overlap |

8 a.m. – 12 p.m. |

Highest liquidity; ideal for breakout and trend trades |

| U.S. Session |

9 a.m. – 2:30 p.m. |

Reaction to U.S. news, inventory releases |

| EIA Report |

Wednesday 10:30 a.m. |

Sharpest weekly volatility; opportunity & risk peak |

| Daily Close/Roll |

4 p.m. ET |

Positions shift; trend reversals may occur |

Conclusion

In conclusion, understanding the crude oil market timing is essential for constructing effective strategies and managing risk. Timing trades for maximum liquidity and volatility can significantly enhance execution quality and profit potential.

Whether you're day trading breakouts, swing trading structure, or aiming to hedge against macro risk, aligning entries with session overlaps and scheduled events offers the highest probability setups.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.