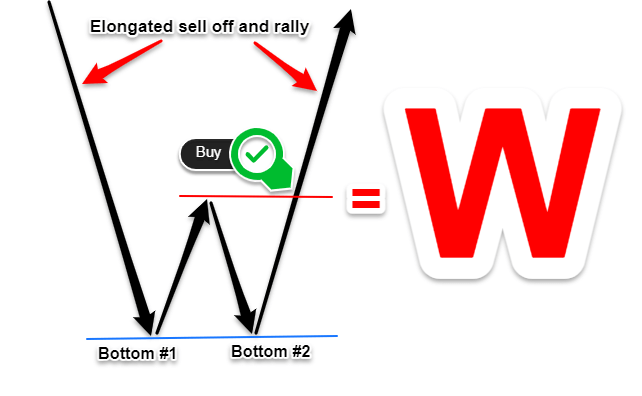

In technical analysis, Chart Patterns are vital for traders to anticipate potential market movements. One such pattern is the W pattern or the double bottom. This pattern is renowned for signalling bullish reversals, offering traders opportunities to capitalise on upward price movements.

In this comprehensive guide, we'll explore the intricacies of the W pattern, its formation, variations, and strategies to trade it effectively.

Understanding the W Pattern in Trading

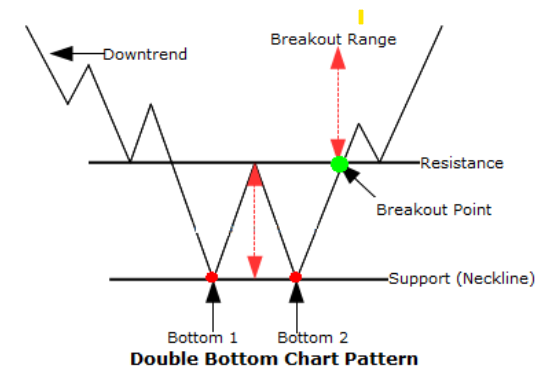

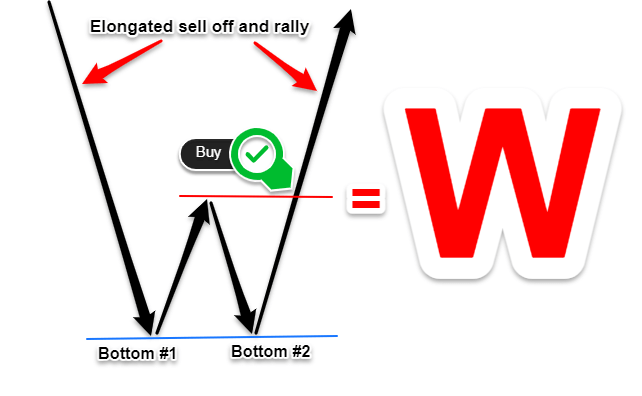

The W pattern is a bullish reversal chart pattern that typically forms after a prolonged downtrend. It resembles the letter "W" on a chart, characterised by two distinct troughs (lows) separated by a peak (intermediate high).

This formation indicates that the asset's price has tested a support level twice and failed to break below it, suggesting a potential shift from a bearish to a bullish trend.

Key Characteristics:

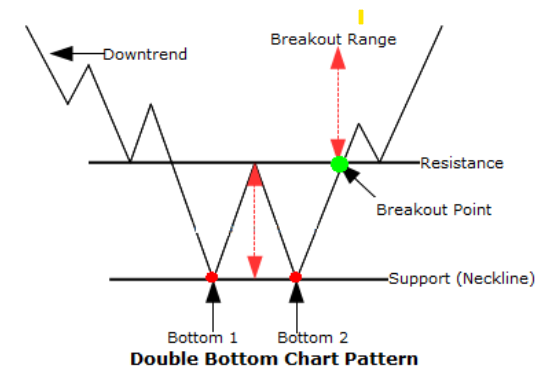

First Trough (Low): The price declines to a new low, indicating strong selling pressure.

Intermediate Peak: A temporary rebound occurs as buyers enter the market, forming a peak.

Second Trough (Low): The price declines again but finds support near the previous low, forming the second trough.

Breakout Point: The pattern is confirmed when the price breaks above the intermediate peak, signalling a bullish reversal.

It's essential to note that the two troughs don't have to be at the same price level, but they should be relatively close to indicate a valid W pattern.

Variations

1. Simple W Pattern

The standard double-bottom formation, consisting two similar lows and a clear breakout above the intermediate peak.

2. Short-Formed W Pattern

Occurs over a shorter time frame with smaller price movements. The second low is higher than the first, indicating increasing buying interest and a potential bullish divergence.

3. Extended W Pattern

Forms over a longer time frame with larger price movements. The second low is lower than the first, suggesting a deeper test of the support level before a reversal.

How to Trade the W Pattern: Step-by-Step Guide

Step 1: Identify the Pattern

Look for the characteristic "W" shape on the price chart, ensuring the two troughs are relatively similar in depth and the intermediate peak is distinct.

Step 2: Confirm the Breakout

Wait for the price to break above the intermediate peak (neckline) with increased volume, confirming the bullish reversal.

Step 3: Enter the Trade

Enter a long position once the breakout is confirmed. Some traders prefer to wait for a retest of the breakout level to ensure its validity.

Step 4: Set Stop-Loss and Take-Profit Levels

Stop-Loss: Place below the second trough to limit potential losses.

Take-Profit: Measure the distance between the troughs and the intermediate peak, then project that distance upward from the breakout point to set a profit target.

Here's how to place entries and exits like a pro:

| Component |

Strategy |

| Entry |

Buy after a close above the neckline with strong volume |

| Stop-Loss |

1–3% below the second bottom (support level) |

| Take-Profit |

Equal to the distance from bottom to neckline, or use a 1:2 or 1:3 risk-reward ratio |

Real-World Example

Let's consider a hypothetical example using a U.S. stock:

Suppose Nvidia has been in a downtrend, declining from $100 to $70. The price rebounds to $80 (intermediate peak) before dropping again to $72 (second trough). Subsequently, the price breaks above $80 with increased volume, confirming the W pattern.

Entry Point: $81 (after confirming the breakout)

Stop-Loss: $70 (below the second trough)

Take-Profit: $90 (projecting the height of the pattern from the breakout point)

This trade offers a favourable risk-reward ratio, aligning with sound trading principles.

Additional Strategy: Combining W Pattern with Technical Indicators

In addition, traders can enhance the reliability of the W pattern by combining it with other technical indicators:

Relative Strength Index (RSI): Look for bullish divergence, where the price forms lower lows, but the RSI forms higher lows, indicating weakening selling pressure.

Moving Averages: A crossover of shorter-term moving averages above longer-term ones can confirm the bullish reversal.

Volume Analysis: Increased volume during the breakout strengthens the validity of the pattern.

Common Mistakes to Avoid

Avoid these pitfalls when trading the W pattern:

Entering too early: Don't anticipate the breakout—wait for confirmation.

Ignoring volume: A breakout with low volume may be a false signal.

Misidentifying the pattern: Ensure the two bottoms are clear and the neckline is well-defined.

Skipping stop-loss: Always protect your capital in case the breakout fails.

Over-leveraging: Junking risk management often leads to massive losses.

Conclusion

In conclusion, the W pattern is a powerful tool in technical analysis, signalling potential bullish reversals after a downtrend. Therefore, traders can improve their decision-making process by understanding its formation and variations and incorporating additional technical indicators.

As with any trading strategy, it's crucial to practice proper risk management and remain disciplined to navigate the complexities of the financial markets successfully.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.