The allure of penny stocks is obvious: small price, big upside potential, and the possibility of spotting a breakout before the crowd. However, with that possibility comes significant risk due to low liquidity, high volatility, and frequently poor fundamentals.

In 2025, the key is not just picking any stock under $1, but finding those with real catalysts, rising volume, credible management, and sector tailwinds.

Below, you'll find a curated look at penny stocks trading under $1 (U.S.-listed) with promise, along with frameworks for evaluating them. We'll also cover risk controls, key metrics to monitor, and how to create a small, balanced strategy.

Key Criteria to Pick a Promising Penny Stock

Before diving into names, here's a checklist you should apply to separate potential winners from likely traps:

1. Rising Volume and Liquidity: Volume that's increasing over time, not just isolated spikes.

2. Sector Tailwinds: Biotech, AI/tech, renewable energy, etc.

3. Reasonable Fundamentals or Path Forward: Some revenue, path to profitability, technological or product potential.

4. Strong or Aligned Management: People with skin in the game.

5. Low Dilution Risk: Check if share count is ballooning through convertible debt or reverse splits.

6. Clear Catalyst Roadmap: Upcoming product launches, regulatory events, partnerships, etc.

7 Penny Stocks to Buy Under $1 with Potential (2025)

Below are several penny stocks (under $1) that are actively traded or showing signs of interest. These are not endorsements, but candidates worthy of deep research.

| Ticker |

Approx Price* |

Business / Sector |

Potential Catalyst / Why Watch |

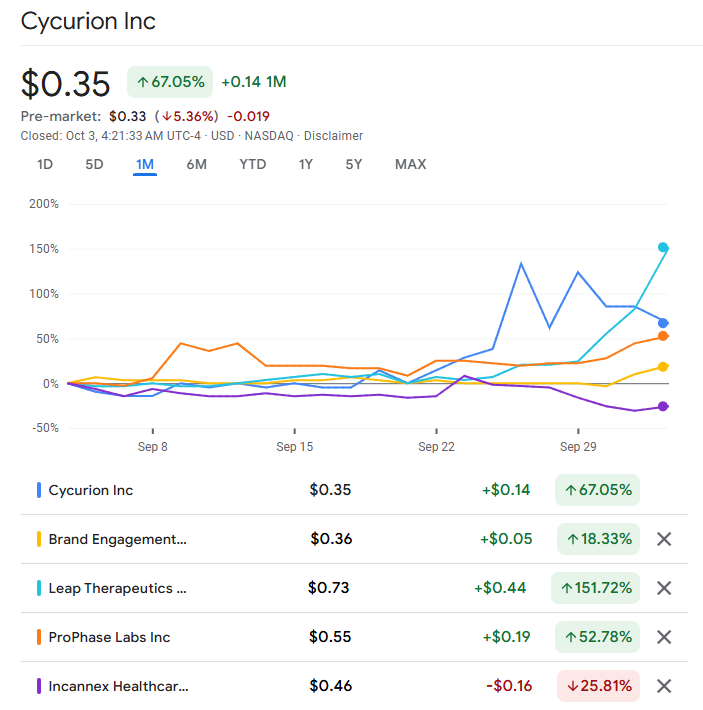

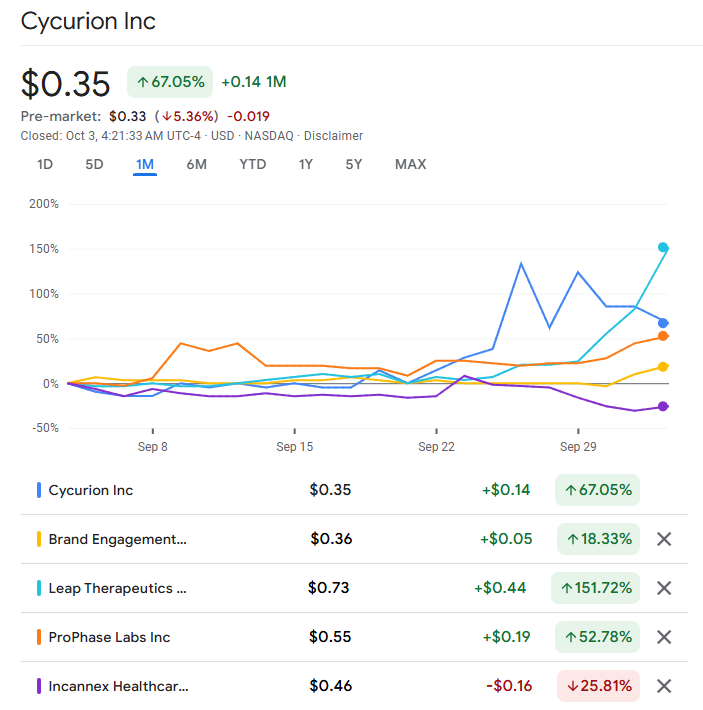

| CYCU |

$0.35 USD |

Tech / cybersecurity |

Rising interest in cyber, small cap bounce potential |

| BNAI |

$0.36 USD |

Digital / media |

Moves in engagement, potential partnerships |

| LPTX |

$0.73 USD |

Biotech / healthcare |

Clinical trial updates or regulatory news could move it |

| PRPH |

$0.55 USD |

Health / nutraceuticals |

Product approvals or market expansion possibilities |

| WGRX |

$0.80 USD |

Healthcare services |

Growth in outpatient or health services segments |

| BIT Origin (BTOG) |

$0.49 USD |

Consumer / digital |

Branding, scaling, potential acquisition interest |

| IXHL |

$0.46 USD |

Healthcare / biotech |

Research progress, partnerships, or licensing deals |

*Prices are approximate and from recent listings. These can change rapidly

Quick Introductions to Each Penny Stock

1) CYCU

A cybersecurity-focused penny stock that's catching interest as cyber threats remain a priority globally. Its small-cap structure makes it volatile but potentially rewarding if investor sentiment turns toward cybersecurity plays.

2) BNAI

Operating in the digital media space, BNAI has seen spikes in speculation about partnerships and engagement-driven growth. It's a risky but watchable bet for those tracking digital adoption trends.

3) LPTX

A biotech penny stock, LPTX's moves are often tied to clinical trial updates. Any positive regulatory development could give it a sharp, speculative boost.

4) PRPH

Specialising in nutraceuticals and wellness products, PRPH could benefit from growing consumer demand for health and supplement products. Product approvals or expansion into new markets remain key catalysts.

5) WGRX

Focused on healthcare services, WGRX is gaining attention as outpatient care and broader health service demand grow in the U.S. Its low price makes it speculative but interesting in a high-demand sector.

6) BIT Origin (BTOG)

A consumer/digital play, BTOG has been on watchlists due to its potential branding growth and acquisition appeal. For speculative investors, it represents a turnaround candidate.

7) IXHL

This healthcare/biotech company has attracted attention due to its continuous research advancements and possible collaborations. Like many biotech penny stocks, news-driven volatility is the main driver.

Why These Picks May Have Upside

1. Sector Tailwinds

Many of these names within these categories are located in tech, biotech, cyber, or digital fields, as these industries are experiencing significant interest and capital influx in 2025.

2. Relative Breakout Potential

Stocks near their upper price bound (e.g. nearing $1) tend to attract breakout speculators.

3. Catalyst Sensitivity

A single favourable trial result, regulatory approval, or major partnership can send penny stocks soaring. The reverse is also true.

4. Low Downside Floor

Since the downside is limited (you can't go below $0), risk is somewhat bounded (though not zero, because many penny stocks can go to zero or be delisted).

5. High Volatility Flows

These names often respond strongly to market sentiment, small inflows, and trading momentum.

However, tread carefully as these stocks often face threats from pump-and-dump schemes, reverse splits, and severe dilution.

Risk Blocks & Red Flags to Watch

Speaking of risks, many of these stocks are also at risk of delisting if they cannot maintain a share price above $1 for a sustained period. Thus, the risk of removal from the exchange rules is real.[1]

In fact, FT reported that in 2024, seven of the top 10 most traded U.S. equities were penny stocks < $1, many with no profits, a sign of speculative mania. [2]

Therefore, be on the lookout for:

Low liquidity can lead to big slippage and an inability to exit positions.

Frequent reverse splits are common in failing penny stocks.

Dilution from convertible debt, share issuances, and warrants.

Weak or opaque financials.

High susceptibility to rumours, social media hype, and manipulation.

How to Trade or Invest in Penny Stocks? Practical Guide

1) Position Sizing & Exposure

Keep these names as small allocation bets within your portfolio. A few per cent is reasonable, not more.

2) Use Limit Orders

Market orders may be executed at poor prices in volatile penny stocks.

3) Watch Volume Trends

Only trade when volume is rising meaningfully; skip stagnant names.

4) Set Stop-Losses or Trailing Exits.

Don't let a small loss blow out; be strict.

5) Time Horizon

Penny stocks often move fast. Prepare to take advantage of short-term catalysts, rather than holding indefinitely unless you possess a solid conviction and strategy.

6) Diversify Your Picks

Spread your bets across a few penny names rather than betting all on one.

7) Check for Upcoming Catalysts

Monitor upcoming trials, filings, partnerships, news events and time entries related to these.

8) Monitor Dilution & Share Issuance.

Track SEC filings for new share offerings, warrant conversions, etc.

Frequently Asked Questions

1. Which Penny Stock Sectors Are Performing Best in 2025?

In 2025, cybersecurity (CYCU), biotech (LPTX, IXHL), and healthcare services (WGRX) are drawing investor attention due to rising demand and sector growth potential.

2. Are Penny Stocks Under $1 Safe to Invest In?

Penny stocks carry high risk and volatility. While they offer potential for quick gains, they are also prone to sharp declines, low liquidity, and speculative moves.

3. Are Biotech Penny Stocks Still Worth Watching in 2025?

Yes, biotech penny stocks like LPTX and IXHL remain on watchlists because clinical trials or FDA approvals can cause sharp price moves.

4. Should I Buy Penny Stocks for Long-Term Investing or Short-Term Trading?

Penny stocks are generally better suited for short-term trading given their volatility. Long-term investing in penny stocks is highly speculative unless the company has a clear growth trajectory.

5. Can Penny Stocks Really Go From Under $1 to $10 or More?

Yes, but very rarely. Many well-known companies once traded as penny stocks before scaling up.

Conclusion

In conclusion, penny stocks under $1 carry both the dream and the danger. They offer the possibility of huge upside if you hit a breakout, get the timing right, and avoid scams. But they're also fraught with traps: low liquidity, manipulation, dilution, and delisting risk.

Among the tickers we examined, each offers a different flavour of risk and potential. Use the checklist above to vet your picks, limit your exposure, and trade smartly.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.reuters.com/markets/us/nasdaq-considers-stricter-delisting-rules-penny-stocks-2024-08-08/

[2] https://www.ft.com/content/c02e4317-e39d-4d0d-a80a-1fd74add72ba